|

Getting your Trinity Audio player ready...

|

This section offers links to ads and other information on opportunities in various fields (employment, education, investment, volunteering, consumer savings, etc.).

INVESTMENT

Stocks or Stones?

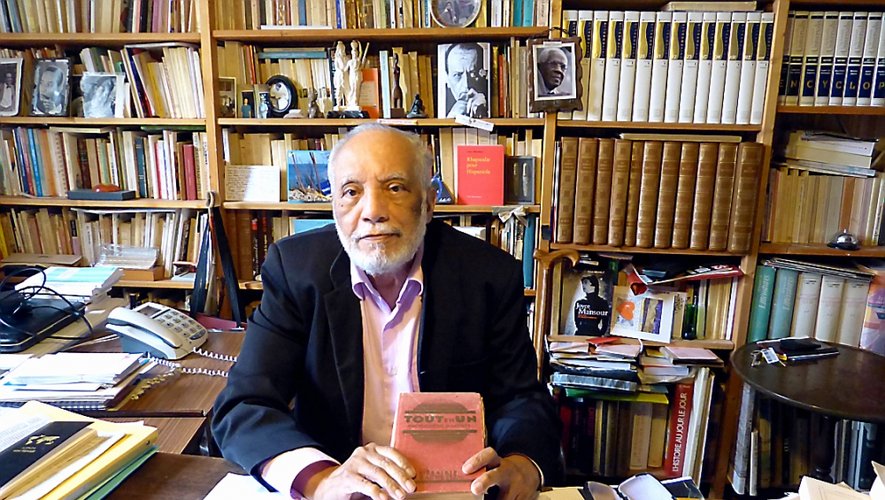

By Jean Jonassaint

We often say “stocks or stones,” or the opposite “stones or stocks,” as if they were two irreconcilable modes of investment. However, investing in the stock market allows you to acquire real estate, just as real estate can help you to build a stock portfolio.

So, it doesn’t matter whether you choose to invest in real estate or in the stock market. The two complement each other. In my humble opinion, even if stocks have historically done better than stones, particularly in North America, the crucial mistake would be to put all your eggs in one basket.

And the capital mistake too often made by modest families is to sit on a property, mortgage-free, on the pretext that the stock market is risky, as if real estate, like any form of investment, didn’t have its ups and downs, in other words its risks.

That said, you shouldn’t start investing without preparation. You need to know the rules of the market: how to buy? what to buy? when to buy? when to cash your profits? when to take losses?

You must also know yourself. What are your financial and psychological limits? How rich do you want to be? In other words, what are your financial capacities (assets, net income, borrowing capacity, etc.)? To what extent can you withstand a major market downturn or a stock market crash?

While answers to these latter questions depend largely on everyone’s temperament or situation, market rules are a matter of public record. Today especially they are widely explained by reliable financial or governmental institutions. These rules enable us to find our way around depending on the country in which we operate, for what is valid for Canada is not necessarily so for France or the USA. You can also call on the services of a financial advisor. Most major banks in North America and Europe offer these services. Of course, it’s not cheap. But never forget the wisdom in my late mother’s saying, inherited from her late father, “Cheap is expensive”. It’s plausible that the costs associated with a financial advisor are ultimately less than those of entering the stock market without a guide.

And here is another saying, this one entirely my own: “People are poor not because they want to be poor, but because they refuse or are afraid to be rich.” In other words, if you don’t want to be rich, you can’t be rich. This conclusion is equally valid for nations, and in this sense, if memory serves me correctly, it echoes Fodé Diawara’s thesis in his Manifeste de l’homme primitif (1972). Come to think of it, I have an inkling we all would benefit from reading or re-reading this nearly forgotten book.

And now let’s get back to business! Whatever your choice, it’s important to get a basic education before investing, especially in the stock market. Here are a few websites to help you do just that:

How to start investing | Investing for beginners | Fidelity

Investing in Stocks for Beginners

Beginner basics: What is investing in the stock market all about?

Bonne lecture!

If you have any comments or suggestions, do not hesitate to write to us. In advance, thank you very much.