|

Getting your Trinity Audio player ready...

|

Some links to ads and other information on opportunities in various fields

FINANCE | INVESTMENT

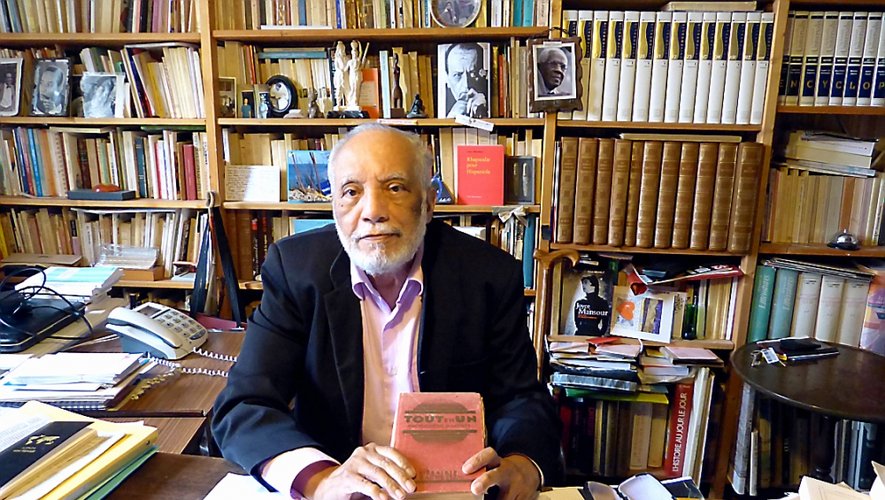

Jean Jonassaint

Today, more than ever, we all want to increase our income, make the most of our investments or our savings. For some, it is not necessary to take any risk, and with the current inflation and the rather high interest rates, the stock markets falter, the real estate market is not the most affordable. What should we to do? Where should we put our savings? It all depends on the country where you are.

In France, one of the most popular and oldest forms of savings is the “Livret A” which allows you to accumulate interest tax-free, and open to everyone, whether or not you are French citizens or residents. The minimum placement is only €10; and the maximum, €22,950. For more information on Livret A, visit: https://www.service-public.fr/particuliers/vosdroits/F2365 or https://www.france24.com/en/tv-shows/french-connections/20230316-livret-a-exploring-france-s-favourite-nest-egg.

In the United States, less known, and just as advantageous, allowing up to a certain point to accumulate interest tax-free are the “I Bonds”. They can only be purchased directly from the US Treasury @ https://www.treasurydirect.gov/savings-bonds/i-bonds/: online from a minimum of $25, by mail in paper format in increments of $50, $100, $200, $500, or $1,000; and in all cases up to a maximum of $10,000 per taxpayer per year.

In Canada, since 2009, there is also a type of investment completely sheltered from taxation, and allows more flexibility in the types of investments, it is the TFSA (Tax-Free Savings Account) whose ceiling for 2023 is Can$6,500. Rather different from the “Livret A” or the “I Bond,” it is closer to the Canadian Registered Retirement Savings Plans (RRSP), and an equivalent to the American Roth IRA. As the Canada Revenue Agency’s “Tax-Free Savings Account Guide” clearly points out, it can include “cash, guaranteed investment certificates, government debt securities and bonds companies, mutual funds and securities listed on a designated stock exchange.”

Bonne lecture!

If you have any comments or suggestions, do not hesitate to write to us. In advance, thank you very much.